insight

Marketing Recap: January 2020

January is already nearing its end, and that means there’s plenty of marketing stories to look back on. From old favourites to new beginnings, there’s plenty for our brand design agency in Leeds to discuss!

This Girl Can… Again

During our 2010s marketing special we highlighted the This Girl Can campaign as one of the decade’s success stories. Now the campaign is marking its fifth anniversary, with a new advert highlighting women in exercise.

The goal of the campaign is to destigmatise women exercising, and encourage more exercise. Unfortunately, many women stop exercising (or are discouraged from exercising) for several reasons. Common reasons include period pains, or not having the “right” body type. As a result of this the video shows a wide range of women benefitting from exercise, free of judgement or self-consciousness.

There’s certainly a case to be made for the re-emergence of the campaign. According to the BBC, 3.5 million women have taken up physical activity since its launch five years ago. At the same time, 40% of women over 16 still aren’t active enough to get the benefits of physical activity. With luck, this new ad can help to bring that second number down a bit.

The Stage is Set

Leeds event transport company Stagefreight is opening a brand new facility in Exeter. The company handles transport jobs for a wide range of exciting clients, including English National Ballet, Joan Baez and Mr Kipling. The new facility—at Hill Barton Business Park—will allow them to better serve their clients based in the south of the country.

The new facility is being overseen by experienced driver Ross Hemsworth, who’s worked alongside artists like Beyonce, Coldplay and Paul McCartney. In addition to this he’s a voting member of the US Songwriters’ Hall of Fame, and former host and director of various live and pre-recorded shows.

As well as a major success for Stagefreight, this is great evidence of a thriving business in the Leeds area. You can read more about our work with Stagefreight in our Stagefreight SEO and social media case study.

Music to Our Ears?

The Verge reports that audio equipment company Bose is closing all of its retail outlets in North America, Europe, Japan and Australia. A total of 119 stores will close, though stores in other parts of the world will stay open for now.

Bose stores first opened in 1993, and gave customers the chance to buy headphones, portable speakers and other audio equipment. The closure of stores represents a win for customer convenience (and the popularity of ecommerce). It’s actually the rise of ecommerce that’s driving Bose’s store closures in the first place.

Audiophiles will probably feel the loss more deeply. A range of products (including Bose’s) benefit from the try-before-you-buy experience that physical stores offer. However, its popularity online suggests it’s less of a problem than we think.

The key lesson here is that having a strong ecommerce presence is vital. With established brands like Beales continuing to close, making your products and services easy to find is more important than ever before.

Child’s Play

YouTube have recently made some major changes to their privacy practices. Last year, regulators said YouTube violated a piece of American legislation called COPPA—which aims to protect children online—by illegally harvesting children’s data for profit. As such, Google has paid a $170 million fine and changed the way they collect information on children.

Under the new rules, all YouTube creators must label all their videos as made (or not made) for children. If they get it wrong, they face hefty fines of up to $42,530 from the Federal Trade Commission. However, labelling a video “child-friendly” on YouTube means disabling numerous features. These features—including targeted ads and comments—make it easier for creators to build an audience and monetise their own content.

It’s not clear how big the impact will be going forward. Mashable points out that there is a “general audience” designation, and this will help creators whose videos fall into a grey area. At the same time, Variety reports at least one channel has closed in response to the changes. Since creators are responsible for labelling their own videos, there’s some real anxiety over getting it right, and whether their channels are sustainable in their current form.

A Matter of Pride

An LGBT pride organisation has voted to ban Google from their future events. Vox reports that earlier this month, members at an SF Pride meeting voted in favour of this recommendation, though only a small number of members voted and attended. It’s not yet clear what weight the vote has, or if SF Pride’s board will pass these motions.

The vote is motivated by what SF Pride sees as homophobic actions on Google’s part. Google has engaged in LGBT-friendly actions in the past, like paying for its employees’ gender confirmation surgery. However, sites like YouTube are apparently still hosting videos from hateful content creators, including controversial commentator Steven Crowder. YouTube has also restricted and demonetised videos with LGBT content in the past, potentially undermining their actions elsewhere.

Companies like Google and Twitter have a conflict between maximising user numbers and protecting their more vulnerable ones, and it’s a conflict that we’ll probably see for some time. More pertinently, it shows that companies have to consider the impact of all their actions on their customers. If your decisions are hostile or controversial, you can often expect some backlash as a result.

Brand New Entry

Netflix is now the UK’s most popular brand, overtaking Aldi for the first time in six years. According to Marketing Week, Netflix tops YouGov’s annual BrandIndex ‘Buzz’ rankings, which track the brands we like best as consumers. Netflix also appears on the ‘most improved brands’ list, in fifth place (Northern Rail has the top spot.)

Netflix’s success is driven by its heavy investment in original content—Variety reports that the streamer spent around $15 billion on movies and TV shows last year. Highlights included the third season of hit horror show Stranger Things, nature show Our Planet and Martin Scorsese behemoth The Irishman. But third-party content is still a major draw. Netflix recently acquired the UK rights to the beloved Studio Ghibli film catalogue, including hits like Spirited Away and My Neighbour Totoro.

Even with this newfound popularity, Netflix have a fight on their hands. Rival streaming service Disney+ is launching in the UK on the 24th of March, with hit shows like Star Wars spinoff The Mandalorian. They’ll also be launching at a lower price point than Netflix, though their actual content library is still up in the air. In any case, UK consumers will have plenty to watch as the year continues.

Come Fly With Me

Leeds Bradford Airport may be getting a new £150 million terminal building. According to BBC News, the old terminal will be demolished and replaced with a new one, covering three storeys and 34,000 square metres. By doing so, the airport hopes they can increase passenger numbers by three million over ten years. Travellers can see the completed building in 2023.

Leeds and Bradford’s councils sold the aiport 12 years back in an effort to attract private investment. While that might be coming, the planned terminal faces some new hurdles, including official approval and fierce protests from climate activists Extinction Rebellion. However, the new building is supposedly planned to be one the UK’s most environmentally efficient.

The Ugly ‘Tooth’

Colgate has unveiled a new vegan toothpaste, reflecting a wider trend of ethical products. The toothpaste differs from similar products because it doesn’t contain glycerin, which can—in some cases—be made using animal oils. The toothpaste also comes in a plastic tube that can be completely recycled. Colgate will share the technology used to make the tubes with competitors, in an effort to reduce carbon footprints.

There are a couple of drawbacks to the toothpaste at the moment. Price will be a key concern for customers; they have to spend £5 on a 75ml tube, which limits it to wealthier shoppers. Moreover, the vegan toothpaste may not be viable in certain markets. Colgate sells the toothpaste in China, which requires animal testing before the product can be sold.

The green credentials of products are, increasingly, a key factor in whether we buy them. Reports from the London Toy Fair show eco-conscious toys (using cardboard, vegetable inks and even soil) are also growing more popular. However, toys like this must consider the safety of the children using them, which restricts material choice and overall design. Brands should anticipate a few bumps on the road if they’re trying to improve what they sell.

Boost Your Business

The key lesson from January is on how you can maximise your value to customers. Bose shows that having a strong, accessible web presence is essential nowadays. At the same time, Google’s troubles show how we have to consider our customers’ other interests. Other businesses like Stagefreight are taking a bold step to better serve their clients, and they have the benefit of experienced staff to carry it out.

Wondering about the next step for your business? We at Electric are here to help! Our brand design agency in Leeds offers many different services for our clients. We can build beautiful websites from scratch, with responsive design and a top-notch user experience. We also incorporate SEO into our web design, and can provide a PPC marketing plan to help you grow your business.

Need help with social media instead? We can plan out your social media messages in advance, or just support your existing social media strategy instead. We can also give advice on how to better connect with your audience and how to best build your brand online.

Browse our full list of services, or just call us now on 0113 287 9900.

Marketing Recap: New Year Special

2020 is here, and with it comes some exciting new year marketing campaigns! Join us as we delve into the big trends of the moment, and learn more about what our creative agency in Leeds has to offer.

Volkswagen’s Last Mile

On New Year’s Eve, Volkswagen released a video bidding farewell to the Volkswagen Beetle. The so-called “People’s Car” is one of the company’s most famous vehicles; three different versions were produced between 1938 and 2019. Its small size made the Beetle an icon of counterculture, but with today’s motorists preferring crossovers and SUVs, production ceased last July.

The video shows the Beetle’s journey through the 20th century, with appearances from a few famous figures along the way. It also references Volkswagen’s prior marketing, including their famous Think Small campaign. The nostalgic feelings are aided by the ad’s ‘rotoscoped’ animation, which dates back to films like Disney’s Snow White.

Volkswagen’s emphasis on both nostalgia and future products make sense when we consider their recent history. In 2015 the carmaker was mired in scandal when they admitted to fixing emissions tests. Volkswagen paid out over $4 billion as a result, but they’re also facing a class-action lawsuit in the UK over emission-cheating software.

With challenges like those, Volkswagen needs all the goodwill it can get. Drawing on the nostalgia of Volkswagen fans is one way they might do so.

Every Mind Matters

Football fans were inspired to consider their mental health during a recent football game. The video below was broadcast during the third round of the Emirates FA Cup as part of the Every Mind Matters campaign. A partnership between Public Health England and the NHS, it encourages people to manage and improve their mental wellbeing.

The video’s broadcast during a football match (to a male-dominated audience) is no accident. According to mental health charity CALM, suicide is the biggest killer of men under 45 in the UK. However, Heads Up (a coalition of mental health charities) also brings together charities with varying focuses, suggesting that no-one is getting left behind. The timing of the ad is also significant; during the winter months we’re susceptible to Seasonal Affective Disorder, which can have a dramatic impact on our mood.

With mental healthcare a perennial concern, this is a thoughtful bit of marketing that’s carefully considered its target audience.

The Co-op’s Meat-Free Range

The Co-op has released a new meat-free brand in time for Veganuary. According to Marketing Week, the “Gro” range features over 35 meat-free products; these will be sold in Co-op branches from the 8th of January.

Veganuary is a relatively recent phenomenon, dating back to 2014. That said, vegan foods have proven extremely popular in the UK; a range of fellow retailers—from Waitrose to Greggs—now offer vegan foods. The Co-op’s own research shows the vegan food market is now worth £1 billion, making their new range a very sensible move.

However, the Co-op aren’t the only retailer making a vegan push. Asda have released a new video promoting their vegan range, with a strong ‘no-compromise’ message underpinning it. Vegan foods are very much a legitimate option today, with some strong marketing efforts as a result.

Booking.com’s Resolutions

Travel website Booking.com have launched a new data-driven marketing campaign. The series of adverts shows people realising New Year’s ambitions through travel plans. However, this isn’t just a marketing contrivance. According to AdAge, the site’s research shows 72% of American consumers are interested in taking a trip to help achieve their New Year’s resolutions.

The campaign is the brainchild of former Google VP Arjan Dijk, who has joined Booking.com as its chief marketing officer. Dijk is a big believer in ‘moment marketing’ and season platforms, which allow companies to focus on the most relevant messages.

This kind of data-driven marketing is a great strategy for marketers going forward. Using thorough research to inform your marketing messages is an excellent way to help them land with your target audience. It might require a significant investment of both time and money, but with the right ideas behind your marketing the results will speak for themselves.

Heineken’s Dry Advent Calendar

Advent calendars are normally a December staple, but Heineken have mixed things up with a Dry January calendar. The calendar comes with 31 cans of Heineken 0.0, a non-alcoholic alternative to Heineken’s regular options. Each can contains 69 calories, allowing for some guilt-free “drinking” throughout the first month of the year.

The calendar isn’t actually available for purchase any more, though of course Dry January remains a popular new year’s activity. While some smaller companies are feeling the pinch, others are embracing the period; low-alcohol and alcohol-free drinks continue to increase in popularity. Like vegan foods, it’s clear that we’re seeing some dramatic changes in what we choose to eat and drink… and some key marketing message shifts as a result.

As you can see, the new year marketing is off to a great start—one that reflects our changing priorities. Whether it’s more environmentally-conscious choices or our own wellbeing, there’s plenty of marketing efforts that capitalise on what we want at the moment. However, for our marketing to have the greatest impact, we need an in-depth understanding of what our customers want. For that to work we need to take a leaf out of Booking.com’s playbook and put data-driven marketing at the heart of our activities.

Electric is on hand to help you get the most from your marketing efforts. Our creative agency in Leeds offers a broad spectrum of services; we operate across print, websites and social media for maximum exposure. We can help develop a new marketing strategy from scratch, craft quality SEO and PPC campaigns, and carefully plan all of your social media messages.

Want to learn more about what we do? Check out our complete range of services or just call us on 0113 287 9900.

Marketing Recap: 2010s Special

With 2020 just a few days away, we’ve decided to take a look back at some of the decade’s major marketing stories. Our digital, design and marketing company in Bradford has seen some massive marketing milestones over the last few years. We can’t wait to see what the 2020s have in store!

2010: Gap’s Design Disaster

Clothing retailer Gap has had its share of controversies over the years. Back in 2010 the company made headlines when they scrapped their new logo… a few days after launching it.

Replacing the iconic white letters against a dark blue square, Gap’s new logo used a Helvetica font and offset gradient for a more modern look. According to the Guardian the redesign attracted thousands of angry Facebook comments, as well as 14,000 parodies on a dedicated website.

So what went wrong, exactly? Back in the day, AdAge brought together a team of designers to dissect the logo in more detail. Armin Vit criticised its bland, generic appearance and similarity to rival American Apparel. Jason Santa Maria, meanwhile, argued that Gap’s original logo had too much equity to introduce such drastic changes.

While redesigning a brand is certainly possible, there are many examples of companies getting it wrong. Facebook’s recent redesign proves that overhauling a brand is tricky for even the biggest companies.

2011: Coke’s Share a Coke Campaign

Though Coke is basically ubiquitous as a brand, some of their marketing campaigns do stand out. One of their more popular efforts was their Share a Coke campaign, which put people’s names on the bottle labels for a personal touch.

The campaign first launched in Australia, and was inspired by Coke’s brand values of friendship and community. It proved so popular that it launched worldwide, with 150 popular names available. Later iterations of the campaign were similarly popular; according to Coke’s own website, 2014 saw over a thousand different names and over 150 million bottles sold.

Debranding a product like this is risky, though brands such as Cadbury’s can carry it off without too much trouble. However, it depends on an extremely strong brand for it to be effective. Coke certainly qualifies, and it’ll be interesting to see if other brands can add a personal touch going forward.

2012: Gangnam Style Hits 1 Billion

South Korean rapper Psy made history when ‘Gangnam Style’ became the first YouTube video to hit a billion views. Mixing catchy music, rapid-fire lurid imagery and some memetic dance moves, it’s not hard to see why the video exploded in the way that it did.

Another major YouTube success for 2012 was Dumb Ways to Die, a catchy safety video from Metro Trains Melbourne. It inspired a raft of imitators, as well as a WarioWare-style app on mobile devices.

Psy’s success paved the way for the rise of K-pop internationally; today, South Korean group BTS is one the world’s biggest boy bands. ‘Gangnam Style’ also had other, unexpected impacts; the video proved so popular that YouTube was forced to redesign the site’s views counter.

YouTube remains a massive cultural force in 2019, but it’s not all smooth sailing for the website. The platform faces serious problems like fickle algorithms and a toxic culture that haven’t been properly addressed. It’s far from certain that YouTube can maintain their popularity in the decade to come.

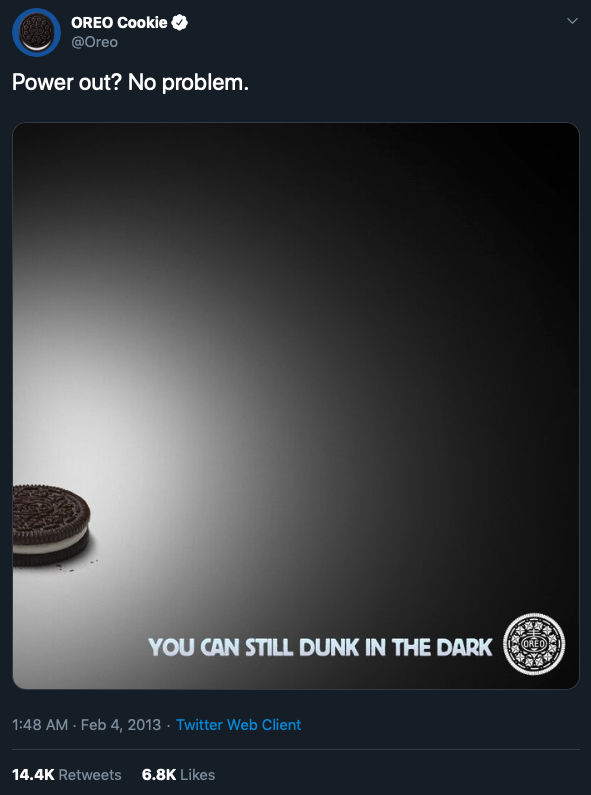

2013: Oreo’s Super Bowl Success

Super Bowl XLVII earned its own place in the history books when the Mercedes-Benz Superdome suffered a 22-minute power outage. The stadium was plunged into darkness, giving Oreo the chance to launch an iconic marketing move.

The tweet won instant acclaim for its wit and spontaneity, with massive success across both Twitter and Facebook. In reality, though, the tweet was less spontaneous than you might expect. It was actually the work of a 15-person social media team, that were standing by to respond to any scenario. In any case, it’s lived on as an excellent example of social media marketing.

2014: Facebook Buys Whatsapp

Facebook made their biggest acquisition to date in 2014, when they bought messaging app WhatsApp for £11.4bn in cash and shares. The app had over 450 million monthly users when Facebook bought it, with the purchase inspired by WhatsApp’s penetration in international markets. This was something that—at the time—Facebook didn’t have in the same quantity.

Though WhatsApp made little money to begin with, it seems Facebook’s purchase was a savvy one. BuzzFeed reports that WhatsApp was on track to beat Facebook at its own game; people were sending far more messages a day on WhatsApp when compared to Facebook’s own messaging service. With only so much attention available from users, Facebook’s acquisition of WhatsApp removed a key competitor and radically improved their own services.

Nowadays, WhatsApp has over half a billion daily active users. With the rise of other services like Snapchat and Instagram, it’s clear that the ways we communicate have radically changed over the last decade.

2015: Female-Friendly Advertising

2015 was marked by a pair of popular marketing campaigns focussed on women. Feminine hygiene seller Always launched their #LikeAGirl campaign, which encouraged girls to push past fear of failure in puberty. Meanwhile, Sport England launched their This Girl Can campaign, which encouraged three million British women to engage in more exercise.

While Always focussed on a relatively young audience, This Girl Can targeted a wider range of ages. This was because there were several different reasons women were reluctant to exercise. Many women worried about how they looked during exercise, while others felt activities like studying or looking after their families were more important.

Though these campaigns seem to have been popular and well-received, it’s still all too easy to run marketing campaigns that patronise women rather than helping them. This was a problem identified by sites back in 2015, but recent marketing blunders like Snapchat’s domestic violence ‘joke’ show it still requires a lot of thought to get right.

2016: The Rise of ‘Fake News’

2016 saw a significant rise of ‘fake news’ in the media we consume. In simple terms ‘fake news’ refers to any story that’s untrue, but believable enough to have a big, real-world impact. Some (relatively) benign examples of fake news include two Russians inventing a billionaire on Instagram, and a Chinese zoo naming a gorilla ‘Harambe McHarambeface’. In other cases it’s more serious; the Guardian reports fake news was a major influence on 2016’s US elections.

Fake news spreads easily because it’s easy to mimic the look and feel of actual news stories. There are also enough true, yet outlandish stories in the news to make fake stories seem plausible. It can even have a serious business impact, as companies like Starbucks and Wetherspoons have learned to their cost.

As a result fake news remains a serious problem, with companies like Facebook reacting to it in different ways. Today’s marketers and consumers have to make sure the info they’re reading and sharing comes from reputable sources, and avoid doing serious damage in the process.

2017: April the Giraffe

New York attraction Animal Adventure Park won some fans when they livestreamed a giraffe’s pregnancy. The New York Times reports that at its peak, the livestream attracted almost five million viewers a day. April the giraffe would go on to have more babies, though she is now retired from the park’s breeding programme.

Today, livestreaming is an extremely popular activity online. It brings plenty of attention to places like Katmai National Park, as well as celebrities like game streamer Tyler ‘Ninja’ Blevins. Livestreaming also gives wider exposure to unusual events, including a Japanese theatre adaptation of the Star Wars movies. It’s safe to say streaming has become an invaluable part of how we consume content online.

2018: KFC Messes Up (and bounces back)

KFC’s savvy marketing proved its worth last year during February’s infamous chicken shortage. The shortage was caused by two key factors—the lack of DHL distribution centres, and the strict regulations surrounding fresh chicken transport. These complexities meant that over half of KFC’s 900 outlets were forced to close.

Instead of trying to shift the blame, KFC faced the criticism head on with a now-iconic marketing message—a tongue-in-cheek, full-page ad in Metro and The Sun.

Simple, honest and very effective, KFC’s ad helped mollify legions of angry KFC fans. At the time of the ad’s launch there were over 50,000 mentions online of the shortage, alongside hashtags like #ChickenCrisis and regular abuse of KFC employees. Reportedly, the ad appearing in print also helped sell their message, since people tend to trust print messages more than digital ones.

Like the Oreo ad before it, KFC shows the value of rapid-response marketing. However, it also shows that when a business screws up, honesty is usually the best policy.

2019: Avengers Breaks the Bank

This year, superhero crossover Avengers: Endgame became the fastest movie to make $2 billion at the box office. The movie tied together plot threads from over a decade of movies, but Marvel’s on-screen universe isn’t going anywhere. Spidey sequel Spider-Man: Far From Home debuted a few months later, with a raft of new films and TV shows planned over the next few years.

Besides making astonishing amounts of money, Marvel movies created an intricate shared universe that no other movie studio has been able to mimic. The movies have also popularised some of Marvel’s less popular characters. Before the movies, fan favourites like Iron Man tended to play second fiddle to other heroes.

Not everyone’s happy with Marvel’s ascendancy in the box office. Legendary director Martin Scorsese made headlines when he compared today’s superhero movies to theme parks. Their success also reflects Disney’s wider domination of the cultural landscape; earlier this year, the behemoth acquired 20th Century Fox. This gave it the rights to a host of properties, including classic shows such as The Simpsons.

New Marvel content on Disney+ means Marvel will be a key part of our culture for a long time. Whether Marvel can push back against franchise fatigue is another question altogether.

An Exciting Decade Ahead

As you can see there are some key marketing lessons from the last decade. A savvy marketing team is always a great idea, as is being honest about your mistakes. At the same time, we must make sure we don’t patronise people with our campaign ideas.

That’s why it’s handy to have a team of expert marketers working as an extension of your business. A savvy marketing team ensures you have a good sounding board for your marketing plans. They can also help you consider all marketing channels, even ones we might have overlooked in the past. This also ensures you don’t miss the chance to use new channels in the future.

If you’re looking for some marketing help in the new decade, we at Electric are here to help! Our digital, design and marketing company in Bradford has a fantastic range of services that help you get the best from your business. We can build beautiful websites from the ground up, help you to thrive on social media and create exciting brands for your products. We can also develop your marketing strategy, use SEO and PPC to increase traffic to your website, and even produce quality print materials.

Take a closer look at our full list of services, or call us on 0113 287 9900. The new decade is almost here, and we’d love to help you face its challenges!

Christmas Marketing Roundup 2019: Part 4—The Results

In this year’s final marketing recap, we look back at the Christmas advert 2019 results. We’ve seen a great selection of ads this year, and there are some key lessons that we can apply to all forms of marketing! Don’t forget to check out Part 1, Part 2 and Part 3 of our Christmas marketing roundup to learn more about this year’s ads.

Aldi’s Amazing Show

The clear winner of 2019 is Aldi’s latest Kevin appearance. Research from Marketing Week shows the ad scored high in a number of key measures, including emotional impact and how enjoyable viewers found it. The data was gathered by asking almost 3,000 consumers their thoughts on this year’s Christmas adverts, with Aldi winning on six of the eight key measures.

So, what set Aldi apart from its competitors? We suspect it comes down to two things—the breadth of pop-culture references, and the product range Aldi’s ad hints at. The retailer has always had a reputation for low prices, and marrying that with the ad’s other elements seems to have been a huge success.

Ikea’s Fresh ‘n’ Clean Advert

Another breakout hit of 2019 is Ikea’s D Double E partnership. Ikea were already a beloved brand, but their new ad is very effective—and extremely catchy. Silencing critics is one thing Ikea won’t have to worry about, with a number of sites praising the advert.

Besides the music, what makes it so effective? Sites like Marketing Week have argued the ad taps into the feelings of dread that family Christmas visits often inspire. City A.M. also praises the ad’s originality—it sidesteps the usual trappings of the Christmas ad without losing the emotions that resonate with us. In an ad season with familiar themes, Ikea has provided a very pleasant surprise.

John Lewis Sparks Our Interest

We all knew this was coming. The John Lewis advert has turned into an event in its own right, and this year’s effort has been very popular. Its tale of an excitable dragon has inspired a raft of merchandise, and a very positive reaction online.

Yet despite its massive emotional impact, it’s not clear that John Lewis has achieved its primary goal. Marketing Week’s research suggests that John Lewis scored poorly on brand memorability; many of us like the ad, but it’s not making us turn out en masse to John Lewis or Waitrose as a result. When we consider John Lewis and Waitrose’s other business struggles, Edgar the dragon may not have been the slam dunk we expected.

Argos Brings It Back

Argos has tried a few different strategies over the years—remember the Christmas Fool?—but this year’s ad played things a bit simpler, focusing on a girl and her drummer dad.

This ad’s success plays upon nostalgia—both for its great soundtrack and its catalogue, which apparently makes its first appearance for over ten years. However, it manages to get some newer references in there, like Cubby the Curious Bear, to keep things relevant. The result is an impactful advert—one that embraces the past, but isn’t beholden to it.

Hafod Hardware’s Childish Things

While companies like Visa have embraced local businesses with their advertising, one Welsh hardware store has taken a more sincere approach to great success. Hafod Hardware’s Christmas ad was produced for £100, and won the praise of several media outlets.

The ad shows a child running his hardware store, with a few age-appropriate diversions. By the end we see him turn into an adult, with a simple message—to be a kid this Christmas.

Hafod Hardware is a little late to the ad release schedule. However, since launching on the 1st of December the ad has been viewed over 2 million times on YouTube. Like Anzara’s own low-budget effort (which we covered in Part 3 of our Christmas recap) it goes to show that a simpler approach can be incredibly effective if your heart is in the right place.

2019 has provided a bumper crop of entertaining marketing efforts. However, the Christmas advert 2019 results have also illuminated a crucial point. For marketing to work, we need to marry an entertaining ad with a strong, clear marketing message. Businesses like Aldi and Hafod Hardware have been able to combine enticing scenes with clear, simple marketing messages. Others, like John Lewis and Tesco, score highly when it comes to memorability. However, this doesn’t necessarily translate into sales or even increased brand awareness.

You can make sure you have a clear marketing message by working with a quality marketing agency. Electric are on hand to create the perfect marketing messages for your business. Whether you need assistance with your branding, print material, website content or social media messages, our digital and design company in Leeds is here to help!

Check out our Services page to learn more about what we can do for your business, or give us a call now on 0113 287 9900.

Marketing Recap: November 2019

The decade is drawing to a close, but there’s still plenty of marketing stories to enjoy! Our marketing agency in Bradford has rounded up some key developments from the last month. From game streaming to digital development, we’ve got something for all our readers to learn from!

Dreaming of Streaming

Back in our March marketing recap we discussed Google Stadia, Google’s new games streaming service. The ambitious service would allow users to play video games with greater flexibility than conventional gaming hardware allowed. Now Google Stadia has launched, and it’s something of a mixed bag.

Gaming sites like Eurogamer have spoken positively about Google Stadia; however, they acknowledge there is a problem with latency, even if that’s not necessarily a dealbreaker. The Guardian also reports playing Stadia games on the go is difficult, since only Google’s phones support the service right now.

Although there are other teething troubles, like a small game library and missing features, we expect Google Stadia (or services like it) to grow in popularity. Streaming services like Netflix have already transformed how we watch TV and films. We expect that something similar will appeal to video game fans.

Thinking Outside the Box

BritBox, a new streaming service focused on British TV programmes, has officially launched for consumers. The service is a new collaboration between the BBC and ITV, with hit shows likes Gavin & Stacey and Love Island. The service will also offer new, exclusive programmes such as Lambs of God.

While BritBox promises a wide selection of TV shows for Anglophile audiences, a few shows (like Till Death Do Us Part) won’t be appearing due to racist or inappropriate content. However, other problematic TV shows (like Fawlty Towers) will feature disclaimers before the episodes are played.

BritBox joins a crowded market of streaming services, with heavy hitter Disney+ due to launch in the UK next March. Its British focus helps to differentiate it from other streaming services. At the same time, it’s another expense to consider in our TV viewing habits. Britbox is also allegedy missing some key features, including content from Channels 4 and 5, several popular programmes and even general device availability.

Still, teething troubles haven’t prevented Disney+ (and original shows like The Mandalorian) from gaining an enthusiastic userbase. Britbox doesn’t have the same cultural clout as Disney but hopefully it’ll be able to smooth out its issues. In a highly competitive landscape, it can’t afford to do anything less.

The New FACE of the Company

Facebook has unveiled a new logo that encapsulates the different strands of their business. An animated GIF version shows the logo cycling between blue, pink and green, representing the titular social network, Instagram and Whatsapp (which are, of course, owned by Facebook too). The logo is also now in all-caps, in contrast to the original, all lower-case version.

Facebook’s redesign reflects the way the business has changed over the last 15 years. As a marketing agency in Bradford, we know the value of a good logo redesign, and it’s a solid design idea. However, the logo itself has drawn criticism from sites like The Verge for its bland, generic appearance.

Moreover, while Facebook (sorry, FACEBOOK) hopes their new logo will foster some goodwill amongst its userbase, that goal is a tough hill to climb. The company has been mired in numerous controversies over the years, including a recent admission that politicians using the platform can lie in Facebook ads. Twitter has banned all political and issue-based advertising in response.

There’s some interesting thinking beneath Facebook’s new logo. However, it’ll take more than a sign change to address Facebook’s various problems.

Taking the Biscuit

John Lewis has started selling a selection of luxury KitKat flavours in its stores. According to York Press, options include Whisky and Ginger, Nuttylicious and Zingtastic Gin and Tonic. If you can’t make it to a brick-and-mortar branch, the KitKats are available on the John Lewis website at the moment.

It’s an interesting move for the company, even if novelty KitKats aren’t that big a novelty. Japan is famous for selling KitKats in a wide range of wacky flavours, including plum soda, soy sauce and (our personal favourite) baked potato. Still, this kind of product is a great fit for John Lewis’ luxury brand, especially around Christmas.

While it’s probably coasting on goodwill from its recent Christmas advert, we recently reported that John Lewis is struggling as a company in our Christmas ad roundup. We doubt this new promotion will do much to change that, though we’re curious to try the Springtime in Japan KitKat now.

Deliveroo? Not For You

Food delivery company Deliveroo is offering a new, delivery-free service called Pickup to its customers. Prolific London reports that it’s a way for customers to save money on orders; customers in places like Spain, Australia and the Netherlands can also take advantage of it upon launch.

It’s not clear if customers will prioritise financial savings over convenience. Moreover, the Financial Times reports that the company is facing a few different problems at the moment. Their delivery staff have complained about working conditions (which Pickup is unlikely to satisfy) and the company as a whole has struggled to make a profit over the years. This last point is an issue with many similar businesses, especially if they aren’t working in an area with high urban density.

Deliveroo expects Pickup to be available at over 10,000 UK restaurants within the next year. If nothing else, they’re giving Pickup every chance to succeed.

“Leeds” The Way

Leeds is being promoted as the UK’s digital heartland. The campaign is being run by a group called the Leeds City Region Enterprise Partnership, and reflects the high level of tech investment in the area.

According to Roger Marsh OBE, Leeds has over 200 tech startups attracting over £100 million in venture capital. This puts it well ahead of its northern competitors. The campaign hopes to build on this with a range of success stories from the Leeds tech community.

Leeds is also home to Leeds Digital Festival, the UK’s largest tech event, and several high profile successes including the new Channel 4 headquarters. We’re proud to work in such a vibrant part of the country, and hope Leeds continues to thrive.

In a way, November has been a great encapsulation of today’s business landscape. Although they’re off to a shaky start, Stadia and Britbox could show us the future of our content consumption. Elsewhere, more conventional businesses like John Lewis and Deliveroo are struggling to adapt to our changing habits. Facebook is also in flux, though it isn’t the first company to use a rebrand to solve its problems.

If you’d like some assistance with your own marketing, Electric is proud to offer many useful services. Our marketing agency in Bradford has experts in getting the most from social media, and we can manage your social media presence for maximum effect. We can also create new branding from scratch, and design beautiful new websites to help your business thrive. Need something more tangible? Our retail packaging and print design services are here to help!

Check out our full selection of services, or just ring us up on 0113 287 9900.

Christmas Marketing Roundup 2019: Part 3

We continue our journey through the weird and wonderful world of 2019’s Christmas ads! Our design and digital agency in Bradford has thoroughly enjoyed our advertising odyssey, and we hope you have as well. If you missed out on our earlier roundups, you can read Part 1 and Part 2 right now.

John Lewis’ Excitable Edgar

Well, it’s finally here—the event we’ve all been waiting for. John Lewis have unveiled their hotly-anticipated Christmas advert; this year, it stars a dragon that enjoys the Christmas season a bit too much. Can his friend reconcile the differences between Edgar and the other villagers?

Edgar’s arrival is accompanied by a range of merchandise, including slippers, wellington boots, glow-in-the-dark pyjamas and—of course—a cuddly toy. The advert has also received very positive reception online, with some fans comparing it to hit TV show Game of Thrones.

At the same time, the businesses advertised have been struggling in recent months. Waitrose has been forced to close seven stores, with some being sold to rising star Lidl. John Lewis has also had to axe a number of head office management roles; both businesses are now run by a single team to save cash.

General reception to the ad seems positive, although it polarised the team at our design and digital agency in Bradford! For now, though, the John Lewis ad remains a beloved event in British culture. Whether that’s enough to attract enough business going forward is a question we’d love an answer to.

Very’s Neighbourhood Watch

Online retailer Very has kept things a little simpler, with a show of neighbourly affection. It shows a series of people working together to create a gift for their elderly neighbour; according to House Beautiful, each character has appeared in a previous Very advert. Its focus on giving presents and spending time with the elderly is sure to win it a few fans.

Although it’s not quite as elaborate as some other ads this year, Very’s effort gets the message across in a succinct, effective manner. We’re quite keen to go back and spot all the characters in Very’s other ads now. Depending on who you ask, John Lewis could have some competition.

Anzara’s Simple Love Story

Video production company Anzara aren’t on many people’s radars. However, this year they’ve turned a few heads with their Christmas ad about a long-distance relationship.

The advert—which sees a gay couple communicating over several months—is the work of filmmaker Phil Beastall. Phil gained acclaim last year for a festive short film with a £50 budget. Both films have a very naturalistic tone, which stands out against other companies’ more fantastical efforts.

The Independent has reacted very favourably to the advert, and shared similarly positive reactions from other viewers. Beyond the flashy, high-profile efforts of the major retailers, it seems there are some smaller gems worth seeking out.

Tesco Goes Back to the Future

Tesco is another company celebrating an anniversary this year—100 years of business! The business first appeared in Hackney back in 1919, though the Tesco name would take another five years to show up. In honour of this milestone, Tesco takes a whistle-stop tour through a century of British history.

Featuring references to Winston Churchill, hit game show Bullseye and a certain Michael J. Fox movie, it’s a nostalgic encapsulation of our shared past. Tesco have even parked one of their delivery vans atop a cottage in Tatton Park to promote the ad, in an impressive bit of real world advertising.

The Guardian reports the ad is an effort to gain goodwill on social media in the run up to key trading periods. We’re inclined to agree with that, and since the ad hits so many nostalgia buttons we’d expect it to do very well indeed.

Ikea’s Moment of Shame

Ikea is famous for its flat-pack furniture, Swedish meatballs and mild, family-friendly brand messaging. This year they’ve decided to mix things up a bit, in a collaboration with East London rapper D Double E.

The advert doesn’t really diverge from Ikea’s overall brand message, but the collaboration lends it a certain kudos. It’s also a very entertaining way of selling viewers on Ikea’s key appeal—attractive, easily accessible furniture.

The ad seems to have been a big success for Ikea, and helped raise the profile of D Double E amongst Ikea’s target audience. Fans of the song, “Fresh N Clean”, can look out for it on their favourite streaming service.

Walkers’ Mariah Carey Collaboration

For several years, footballer Gary Lineker has been the face of Walkers Crisps. This Christmas the company has partnered with another celebrity indelibly associated with the holiday.

It’s a surprisingly tongue-in-cheek portrayal of Mariah Carey, whose gift choices are (ironically) a bit tone-deaf. What isn’t tone-deaf is Carey’s impressive singing ability, which helps her secure the Walkers crisps in the end.

A few commenters have taken issue with Mariah’s enjoyment of the crisps (or lack thereof) but this remains an impressive bit of star power nonetheless.

McDonalds’ Reindeer Games

McDonald’s have indulged in a bit of childlike imagination with their story of a girl and her reindeer. Ellie wants nothing more than to play games with her sister Jenny, but Jenny is too cool for such childish things. Luckily, a baby reindeer is on hand to brighten Ellie’s day.

McDonald’s advertising has to walk a fairly fine line, especially since many of its meals are aimed squarely at children. This advert focuses on the healthy carrot sticks (sorry, “reindeer treats”) that McDonald’s offers, as well as their generous opening hours.

It’s another advert that prioritises a benevolent narrative over product placement, and its widespread use indicates that it’s extremely successful. For our money, this is a very charming effort that uses its cosy animation to great effect.

Co-op’s Community Spirit

Most Christmas ads touch on an idea of community and togetherness, but the Co-op’s ad takes that idea a bit more seriously. It emphasises the impact their charitable giving has on good causes, with a special appearance by one of their beneficiaries.

According to Prolific London, The Co-op supports local causes through a dedicated local communities fund. During its lifespan, this fun has supported over 4,000 causes and donated £17 million. The musicians in the video are part of the BTM Brass Band, A Welsh group inspired by a trio of small mining villages.

Like Anzara’s advert, this is an understated effort that keeps the obvious sales messages in the background. Instead it’s focussing on the non-commercial aspects of the holiday season… which, ironically, could be a path to greater business success for the Co-op going forward.

Have you been enjoying our Christmas roundup so far? 2019 has been an extremely strong offering for Christmas ads, and we’ll be bringing our roundup to a close with our next instalment.

Don’t forget that Electric is here to help with your own marketing requirements. Whether you’re after print design, social media marketing, brand creation or content production, our design and digital agency in Bradford is happy to oblige!

See our services for yourself, or just call us on 0113 287 9900.

Christmas Marketing Roundup 2019: Part 2

We continue our look at the biggest Christmas adverts in 2019! Our marketing agency in Bradford loves a good marketing effort, and we’ve rounded up some of the best. If you missed our earlier recap, you can check out Part 1 here.

Marks and Spencer’s Dancing Jumpers

Marks and Spencer has taken a slightly different tack with 2019’s Christmas advert. Where previous ads included icons like Paddington Bear and… er, Holly Willoughby, this year’s star is a parade of dancing Christmas jumpers.

Featuring hit rap song “Jump Around”, this ad was made by “Single Ladies” director Jake Nava. The Guardian reports the ad is an effort to restore M&S’ flagging fortunes; their clothing sales have seen a sharp drop, and encouraging shoppers to buy M&S jumpers is a way to reverse that trend. The retailer also hopes the shoulder-rolling dance move will gain popularity on social media.

Viral sensations are very difficult to contrive, but there’s some solid ideas under Marks and Spencer’s strategy. Whether it can beat John Lewis on popularity is a whole other question.

Sainsbury’s’ Sweeping Story

Marks and Spencer aren’t the only retailer aiming high; Sainsbury’s made headlines after their planned merger with Asda was blocked. With Aldi and Lidl upending the grocery market, it’s fair to assume Sainsbury’s are after some new customers.

Their new Christmas advert focuses on Nicholas, an orphaned chimney sweep who gets in a spot of bother. Luckily Mrs Sainsbury (and her ‘zero-emission’ cart) are on hand to save the day, with her act of kindess having a much wider impact.

It’s very different from last year’s all-singing, all dancing advert, though Sainsbury’s have created more narrative-driven adverts in the past. It’s also a subtle celebration of the supermarket’s 150th anniversary, and one of the more ambitious adverts 2019 has to offer. While some viewers miss ‘Plug Boy’, this remains a very impressive effort.

Barbour’s Blooming Marvellous Ad

For their 125th anniversary, Barbour have teamed up with Raymond Briggs’ Father Christmas. The character first appeared in 1973, as well as a Channel 4 animation (starring Mel Smith) back in 1991. Now he’s back again, and reflecting on how Barbour has helped him out over the years.

While there’s a bit of retconning at work here, Barbour has been partnering with Raymond Briggs’ creations for some time now. Last year’s advert featured The Snowman—by far Briggs’ most famous character. 2017, meanwhile, saw a Barbour ad inspired by hit sequel The Snowman and the Snowdog.

Although Briggs’ Father Christmas isn’t quite as popular as The Snowman, this ad riffs on ideas of memory and reliability to great effect.

Joules’ Cracking Campaign

Barbour aren’t the only ones teaming up with beloved British icons. High-end clothing retailer Joules has released an ad starring none other than Wallace and Gromit; each of them is celebrating their 30th anniversary this year.

As adverts go it’s a pretty subtle effort; the Joules products play second fiddle to Wallace and Gromit themselves, who were always going to be the main attraction. Still, they’re an excellent partnership for the Joules brand. It exudes a high level of Britishness, which resonates well with these icons of British culture.

Wallace and Gromit are no strangers to advertising. Before partnering with Joules the duo have appeared in adverts for British brands including Npower, PG Tips and The National Trust. They’ve also appeared in a few adverts overseas; our favourite is this odd Japanese dessert ad. In any case, Wallace and Gromit are a pretty safe bet when it comes to marketing.

JD Sports’ Celebrity Showcase

Sportsware retailer JD Sports has produced a short, snappy effort with some serious celebrity clout. It features appearances by the likes of Jesse Lingard, Virgil Van Dijk and singer Ann-Marie, who are all sporting some appropriately stylish gear.

This is definitely an advert aimed at younger audiences, as made clear when several youngsters appear in the advert itself. It’s also extremely punchy, with the celebrity appearances working hand in hand with the overall branding. JD Sports suggests ads don’t need to be too complex to work, even around Christmastime.

Debenhams’ Gift Giving

Last year, Debenhams took a multi-pronged marketing approach with a series of adverts. These showed various people nailing their gift choices for loved ones, courtesy of Debenhams’ diverse product selection. For 2019 they’re taking a simpler approach, with a pair of flashy ads to show off their wares.

The ads are a neat, stylish way to show off the breadth of products that Debenhams offers, with a range of different people served by Debenhams’ range. It also features an appearance by X Factor star Fleur East, who both appears in the ads and provides the musical accompaniment.

Unfortunately, Debenhams has been struggling in recent years. According to the Daily Gazette the department store is closing 50 branches over the next five years, with Kent Live reporting 1,200 job losses. However, Debenhams have also secured £50 million of funding to keep it afloat. Hopefully, these new adverts will help them achieve that lofty goal.

Step Into Christmas

We’re seeing an interesting mix of Christmas adverts in 2019. Brands like Joules and Barbour are playing on classic characters to sell their wares, while the likes of JD Sports and Debenhams are taking a shorter, snappier approach to attract younger audiences. Others like Sainsbury’s are adopting the classic narrative form that brands like John Lewis have had success with. Look out for our next Christmas roundup very soon!

Want some help with your own marketing? We at Electric are a marketing agency in Bradford that’s proud to offer many different marketing services. Our expert team can create new brands from scratch, build stunning websites, and even design retail packaging and POS materials. Need help with your social media instead? We can plan social media messages, support your current social strategy and advise you on the most fruitful channels.

Learn about our services in more detail, or just call us on 0113 287 9900.

Christmas Marketing Roundup 2019: Part 1

They say Christmas comes earlier every year, and when it comes to marketing, that’s often true. Our marketing and digital agency in Bradford appreciates a good Christmas ad. With Christmas adverts in 2019 starting to appear, we’ll be keeping you posted on them as they pop up.

Argos and the Book of Dreams

Argos kicks things off with this exciting Christmas advert, highlighting the retailer’s Christmas gift guide. Like many Christmas adverts nowadays, it focuses more on the feelings surrounding Christmas rather than a specific product. However, it does feature an appearance from Cubby the Curious Bear—an animatronic soft toy, and one of the predicted hits of this Christmas.

The advert also benefits from a legendary song—Simple Minds’ “Don’t You”, which was of course popularised by The Breakfast Club. Argos adverts have been a mixed bag in the past, but this is definitely one of their stronger efforts.

Smyths and the Top Toys for Christmas

Irish retailers Smyths Toys have also released their latest Christmas advert. It features their mascot Oscar in a reprise of his “If I Were A Toy” performance from previous adverts. Unlike Argos, this advert highlights several specific products that kids can enjoy this Christmas.

Smyths have also released a second video highlighting some of this year’s most sought after toys. Highlights include a replica of Forky (from Toy Story 4), a twerking llama and a Lego model of Harry Potter’s Knight Bus.

This is a very safe choice for a Christmas ad, highlighting the specific things children will be after. However, we’re sure it’ll also be a highly effective one.

Aldi and the Leafy Blinders

Aldi’s shift from budget supermarket to the nation’s favourite is well-known at this point. They’re also quite savvy with their Christmas marketing; one of last year’s ads referenced Coca-Cola and The Italian Job. This year’s ads also riff on pop culture darlings, including Peaky Blinders and hit musical The Greatest Showman.

Kevin the Carrot’s latest appearance is a very welcome one. He’s been a popular part of Aldi’s Christmas adverts for a few years, with a Kevin plush toy causing some minor chaos last Christmas. Music from Robbie Williams suggests Aldi is more than willing to step up its game in the marketing arena.

Iceland and the Magic of Frozen

One of last Christmas’ biggest marketing stories came from frozen food retailer Iceland, and their controversial advert about the impact of palm oil. The advert was banned from broadcast on television because of its political nature, but that didn’t stop the ad from gaining massive popularity. However, we later learned that products with palm oil were still appearing in Iceland stores, souring some of the goodwill Iceland gained.

While Iceland are still promoting palm oil-free and vegan foods, the retailer is taking a safer approach this year—a partnership with Disney, which also promotes Frozen II.

It’s a pretty savvy partnership; Iceland still use their “Power of Frozen” message on their website, with this new message very similar in feeling. More importantly, Frozen II promises to be a massive hit this winter. The original is one of the highest-grossing animated films ever created; this sequel is a lucrative connection for a company like Iceland to make. In the wake of last year’s controversy, it’s also a highly understandable one.

These are just the first of several Christmas adverts in 2019. Look out for more advert updates on our blog over the next few weeks. You can also check out our 2018 Christmas advert roundup part 1 and part 2 to see how this year’s adverts compare.

Don’t forget that we’re here to help with your own marketing efforts, at any time of the year! Our services range from brand creation to social media marketing, and many other marketing options besides. Check out our complete range on our Services page, or just give us a call on 0113 287 9900.

Marketing Recap: October 2019

We at Electric—a marketing and design company in Leeds—know the power of fantastic marketing. As such, we bring together some key marketing stories at the end of each month. From Times Square takeovers to emoji bans, there’s something for everyone to learn from!

A Kind of Magic

New York’s Times Square has recently played host to a massive Harry Potter publicity stunt. According to AdWeek it used 51 different screens, with eight digital display companies working together on the project. The finished project stretched over four city blocks, and you can see it for yourself below.

The campaign promotes Harry Potter and the Cursed Child, a two-part play that continues the story of the Harry Potter books. The play has been a critical success, while the scripts sold over 800,000 copies a week after publication. Potter fans have been able to see the play in London, New York, Melbourne and Toronto, with tickets currently available for Broadway productions.

Harry Potter needs no introduction as a franchise, but its legacy lives on in numerous attractions. Examples include Watford’s Warner Bros. Studio Tour, and Florida’s Harry Potter theme park attraction. The play is just the latest one, and it’s a testament to its popularity that something like this is possible. It’s the most memorable marketing activity we’ve seen all year, and a high bar to clear for other marketing campaigns.

Nobody Calls Me Chicken

American fast food chain Chick-fil-A—famous for its chicken sandwiches—will be closing its first English branch. The company opened a branch in Reading’s Oracle shopping centre earlier this month. However, following fierce protests, the Oracle announced they would not be renewing the six-month lease.

Chick-fil-A is very popular in its home country—it has approximately 2,400 branches across the US, and it’s America’s third-largest fast food chain by sales. But people associated with the company have made anti-LGBT comments, as well as donations to anti-LGBT organisations. While Reading Pride—who organised the protests—have had a big impact, Chick-fil-A have already opened a second branch in Scotland with further UK branches likely to open.

Chick-fil-A’s future in the UK is hard to predict. Its relative obscurity here means many people won’t be aware of the politics surrounding it, limiting backlash to its homophobic actions. At the same time, its anti-LGBT stance make the restaurant very popular in more religious parts of the US—an advantage the company can’t count on in the UK.

While the UK and US share a language, the profound cultural differences mean transplanting a business from one to the other is harder than it looks. As American burger chain Wendy’s prepares to open several UK branches (according to the Bristol Post), we look forward to seeing how well it fares.

All You Need Is Dove

Personal care brand Dove has recently announced a new plastic reduction initiative, according to Packaging News. They plan to make their beauty bar packaging plastic-free by next year, and launch bottles made from 100% recycled plastic in Europe and North America.

According to Unilever—who own the Dove brand—the move will cut the use of ‘virgin plastic’ by 20,500 tonnes per year. The move reflects a growing anti-plastic sentiment amongst consumers, though in some respects Dove is ahead of the curve. In 2013, CNN reported Unilever were removing controversial microbeads from Dove products. More recently the Dove brand has been used in progressive marketing campaigns, including a crossover with hit animated series Steven Universe.

At the same time, Unilever still has a lot of work to do. According to Marketing Week, less than 1% of Unilever’s plastic packaging uses recycled materials. In response to this Alan Jope, CEO for Unilever, has encouraged activists to call the company out when they fall short.

In many ways this is a savvy marketing move first and foremost; the spread of plastic is a hot topic for many different people at the moment. Still, it’s a welcome initiative, and should hopefully inspire similar moves from other brands in the future.

Food, Glorious Food

A campaign group has covered a London home in food to highlight the city’s food waste problem. PR Examples reports that Small Change, Big Difference used 3.75 tonnes of food in its display; the figures reflects that amount of food waste produced by 14 households over a year. Across the city, that adds up to 910,000 tonnes being thrown away each year. This in turn has an environmental impact; food waste sent to landfill releases large quantities of CO₂ into the atmosphere.

The food-covered home formed part of a larger campaign, with the group raising wider awareness about sustainable eating. The campaign encourages people to eat less meat, store food properly and recycle food waste where possible. Small Change, Big Difference have also donated all of the food in their house stunt to London charity City Harvest, as well as London residents.

This is an elegant move by a charity that highlights a big problem—not just in London but across the UK. It’s simple but very visually striking, and the fact the group redistributed the food ensures they aren’t compromising their core ideas in the process.

Emoji No More

The Independent reports that Facebook and Instagram are banning the use of emojis in sexual contexts. Infamous emojis like aubergines and peaches can also no longer be used to censor nudity. The rules were apparently first introduced in August, but they’ve only just been spotted by XBiz, a website dedicated to adult industry news.

Facebook’s efforts to limit sexual content mirrors similar moves on other sites. Last year blogging site Tumblr banned adult content, although as The Verge highlighted, the move cost it a significant chunk of its userbase. NPR also reported Craigslist shuttered its personals section (which sometimes included sexual invitations) after the controversial FOSTA legislation was passed in the US Congress. However, Wired reports the UK government’s age checks for online pornography have been abandoned following technical and privacy concerns.

Despite controversies surrounding misuse of the platform and false political ads, Facebook remains a very popular platform; recent figures from Statista suggest it has over 2 billion active users. It’s unlikely the new anti-sex policy will have a dramatic impact on its userbase; unlike Tumblr, Facebook isn’t famous for providing quick access to adult content. At the very least we can expect a vocal minority to cry foul over the new state of affairs.

Take the Right Steps

October has showed us that marketing isn’t always a straightforward task, especially if you’re trying to be progressive or expand overseas. For companies like Dove, any well-meaning initiatives can backfire when people point out your shortcomings. Companies like Chick-fil-A might also encounter some culture shock, though it’s not always clear how much of an impact this will have. The key to marketing success is to be as sincere and honest as you can with your approach.

If you’re looking for some guidance on your own marketing strategy, why not get in touch? We’re a design company in Leeds that can help you develop a detailed marketing strategy, focussing on the ideas with the biggest positive impact. We’re highly experienced in both digital and social media marketing, with SEO content, email design and social account management all available.

Take a closer look at our full service offering, or just call us on 0113 287 9900.

Marketing Recap: Halloween 2019

Halloween is one of the world’s most popular cultural events, and offers plenty of spooky promotions. Because we’re an integrated marketing agency in Leeds, we’ve brought together some frightfully good marketing efforts from Halloween 2019.

Stealth Marketing

PR Examples reports that Poundland are giving away free “invisibility cloaks” this Halloween. The cloaks are “displayed” on a hanger with a card telling people about the contents. If that doesn’t take your fancy, worry not; the discount retailer is offering over 270 Halloween products in stores this year. Ironically, the invisibility cloak could be the best bet for savvy shoppers; the Guardian says that this Halloween will generate 2,000 tonnes of plastic waste.

As marketing campaigns go, this is one of Poundland’s tamer efforts. The retailer found great success with its lewd Elf on the Shelf Christmas campaign, but earned an investigation by the Advertising Standards Authority. They also divided opinion with their Easter campaign, which showed the Easter Bunny in a rather compromising position. It’ll be interesting to see what approach Poundland takes this Christmas.

A Proper Boo

Yorkshire Tea have released a new Halloween-inspired video online. With zombie outbreaks spreading across Yorkshire, can two intrepid Yorkshire Tea employees halt the undead with a decent cuppa? There’s only one way to find out.

The new video is a lot of fun, and it reflects the tongue-in-cheek approach in Yorkshire Tea’s marketing. Recent videos include appearances from Yorkshire celebrities, including Game of Thrones actor Sean Bean and Bradford magician Dynamo. The light-hearted content is paired with more down-to-earth videos on subjects like hard water, helping to establish Yorkshire tea as a serious brand that can poke fun at itself.

Bricking It

Argos have hosted an after-hours Halloween event at their Tottenham Court Road branch. Visitors to the after-hours event could meet ghost hunter Yvette Fielding, who shared ghost stories from across London. They could then embark on a “ghost hunt”, which allowed visitors to see LEGO’s new ghost-themed toy range.

Hidden Side—which we’ve touched upon before in our September recap—combines conventional LEGO sets with AR functions, which people access through a smartphone. By looking at specific models through a phone camera, children can see “ghosts”, which they must defeat to win the game. It joins other toys like LEGO Boost, which mix old-fashioned bricks with new technologies.

At its core this is a LEGO marketing event, but some thoughtful combination with other attractions helps to hide that. It sounds like a lot of fun for its target audience, and it’s an effective way to show off AR functions to its target audience.

Chickened Out

KFC have unveiled a new meal range inspired by Mexico’s Day of the Dead celebrations—an event, we should stress, that is distinct from Halloween, despite launching at a similar time. Their ‘Los Retornados’ video includes testimony from three people who had near-death experiences. Viewers can also receive a lifetime supply of the new Chickadilla product… if they’re willing to put their own obituary in a local newspaper.

The fried chicken chain is no stranger to big, bold marketing efforts. They’ve also proven they can bounce back from controversy, as proved during their chicken shortage last year. Since this seems to be a Spain-only promotion, it’s hard for us to determine if people see this as disrespectful.

If it isn’t, it’s a good event to tie into a marketing campaign. Day of the Dead celebrations are thousands of years old, and its UNESCO recognition has helped it grow in popularity. Animated films like Coco and The Book of Life have also helped propel Day of the Dead into the mainstream.

In that light, a Day of the Dead promotion could be extremely popular. Whether that will lead people to create fake obituaries is another question altogether.

Don’t Be Scared

Capitalising on events like Halloween is always a good idea. While scary content is the most obvious choice, it’s possible to do this in a way that still appeals to a wide audience. If you think you can create a Halloween promotion without it feeling contrived, have a go… and make sure to have fun with it!

Don’t be afraid to get in touch if you want help with your own marketing strategy. Our services include SEO-inclusive website design, content creation, and PPC ad campaigns. We can also manage your social media accounts, plan out messages ahead of time and help you take a proactive approach.

Visit our services page to see everything that we can do, or call us on 0113 287 9900.